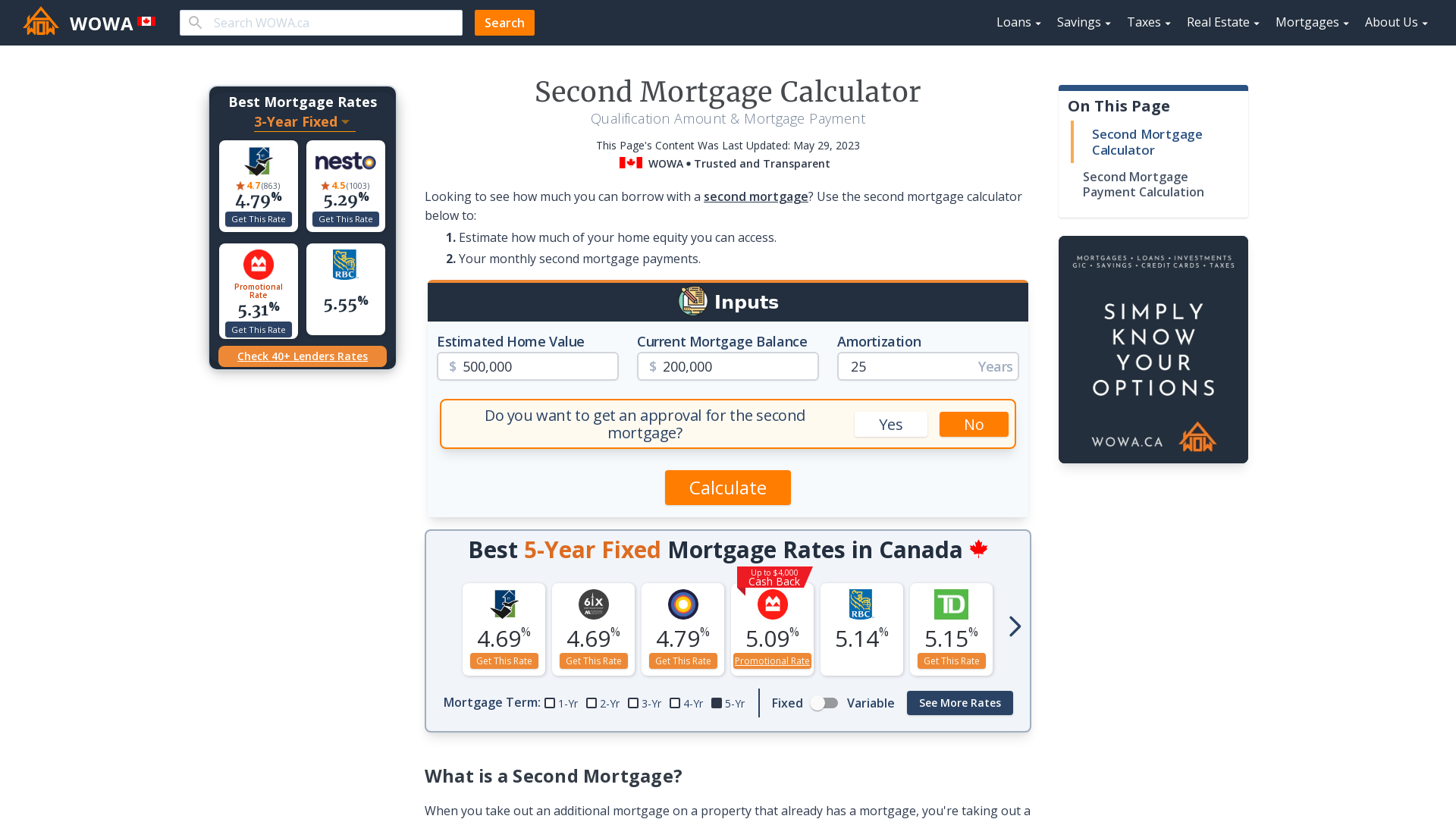

Home equity qualification calculator

A home equity loan often called a second mortgage is a lump sum borrowed against the equity you have in your home. Pre-qualification allows you to input basic details about yourself and your desired loan in exchange for a snapshot.

Home Affordability Calculator For Excel

Home Equity Line of Credit.

. A Home Equity Line of Credit HELOC is a low-cost alternative to high-interest consumer loans and credit cards. High minimum loan amount and many qualification items not specified. This is the best time to refinance your mortgage.

A home equity loan or home equity line of credit HELOC allow you to borrow against your ownership stake in your home. A home equity loan calculator like this one takes that all into account to figure how just how much of a line of credit you may be able to obtain depending on all those factors. The general rule is that you can afford a mortgage that is 2x to 25x your gross income.

As mentioned above banks typically allow a max LTV of 70 to 85. A HECM allows older homeowners aged 62 and up with significant equity or. This tool estimates how much equity you have built up in your home.

From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration. For example say your home is worth 350000 your mortgage balance is 200000 and your lender will allow you to borrow up to 85 of your homes value. Through the middle of 2018 homeowners saw an average equity increase of 123 for a total increase of 9809 billion.

So they charge higher interest rates and generally have stricter qualification standards than regular mortgages do. Use this free calculator to figure out what your remaining principal balance home equity will be after paying on your loan for a specific number of months or years. Then as the COVID-19 crisis struck interest rates crashed to the floor shifting homeowner.

Use Bankrates loan prequalification calculator to determine your ability to qualify for a home or auto loan. Home equity loan calculator. The following table shows the required income needed to have a 28 DTI front end ratio on a home purchase with 20 down for various home values.

The three primary things banks look at when assessing qualification for a home equity loan are. Chase Auto is here to help you get the right car. You can use the menus to select other loan durations alter the loan amount or change your location.

Rising Rates Before the COVID-19 Crisis. According to IRS topic 701 homowners selling their primary residence can often exclude up to 250000 in capital gains on the sale or 500000 if they file jointly with their spouseTo qualify you must have owned the home for at least 2 of the last 5 years leading. At Bank of America we want to help you understand how you might put a HELOC to work for you.

For the sake of this calculation a 30-year fixed-rate home loan is presumed with a rate at 5 APR. Home equity line of credit HELOC calculator. Total monthly mortgage payments are typically made up of four components.

The most common home loan term in the US is the 30-year fixed rate mortgage. This refinance offer may not be advantageous to you if you are currently eligible for benefits provided by the Servicemembers Civil Relief Act SCRAIf you are an SCRA-eligible customer and have questions about the SCRA or about this refinance offer please discuss with your Home Lending Advisor. A draw period during.

Find a mortgage that fits your budget based on your monthly income and expenses. If you want to add extra payments to your loan to pay it off quicker please use this calculator to see how quickly you will pay off your loan by making additional payments. Understanding how your mortgage interest rate is calculated is a crucial step in securing a home loan.

Example Required Income Levels at Various Home Loan Amounts. Leverage Your Home Equity Today. People with an excellent credit score of above 760 will get the best rates.

Your homes equity is the difference between the appraised value of your home and your current mortgage balance. For example if your home is worth 500000 and your loan balance is 300000 youve got a rather attractive 200000 in home equity. A HELOC is not a lump sum but a revolving line of credit also borrowed against your available home.

A HELOC has two phases. Home equity line of credit HELOC calculator. As the Federal Reserve has lifted short-term interest rates in the late 2010s many homeowners who typically opted for the cash-out refi option in the prior decade became more inclined to use a home equity loan or line so they keep their existing low rate on the majority of their home debt.

Households with a broad range of products. One factor this calculator does not take into account is capital gains. Our rate table lists current home equity offers in your area which you can use to find a local lender or compare against other loan options.

Chase Bank serves nearly half of US. The Home Equity Conversion Mortgage HECM is the most popular type of reverse mortgage and is also insured by the FHA. Go to Chase home equity services to manage your home equity account.

Important Notice to Servicemembers and Their Dependents. A HELOC is a line of credit borrowed against the available equity of your home. The following table shows current 30-year mortgage rates available in Redmond.

To find out if you may be eligible for a HELOC use our HELOC calculator and other resources for a HELOC. Home equity loan calculator. Capital Gains Considerations When Selling a Home.

You can borrow up to 80 of your homes appraised value of your owner-occupied home to do things you want to do such as start home improvements take a long-overdue vacation or even pay off your credit card debt. Value of home Mortgage balance Homes Equity. To determine your home equity simply take your current property value and subtract the outstanding loan balance.

A home equity loan is often a fixed-rate term loan with a predictable repayment schedule in addition to your current mortgage. And thats all it takes to use this mortgage calculator with extra payments. Principal interest taxes and.

You might be able to use a portion of your homes value to spruce it up or pay other bills with a Home Equity Line of Credit. Available equity in the home. This means the 63 of homes across the United States with active mortgages at the time had around 8956 trillion in equity.

This number can be used to help determine if PMI should be removed from a current loan or for loan qualification purposes on a mortgage refinance or a credit line against your home equity for up to four lender Loan-to-Value LTV ratios. The interest rates are competitive with other types of loans and the terms. Use our free home affordability calculator to estimate how much home you can afford.

HELOC Home Equity Loan Qualification. Aylea Wilkins is an editor specializing in. Those with good credit.

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator

Second Mortgage Calculator Qualification Payment Wowa Ca

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc Payment Calculator With Interest Only And Pi Calculations

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Qualification Calculator

What Is Home Equity How To Determine The Equity In Your Home Zillow

How Much Home Can I Afford Mortgage Affordability Calculator

Heloc Calculator Calculate Available Home Equity Wowa Ca

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Home Ownership Expense Calculator What Can You Afford

How To Calculate Equity In Your Home Nextadvisor With Time

Home Equity Calculator Free Home Equity Loan Calculator For Excel

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator How Much Can I Borrow Using My Equity